Big News: First Home Buyers can Buy Sooner with Just 5% Deposit

To All First Home Buyers Out There 📣

We’re excited to share some major changes announced by the Albanese Government that could make getting into your first home easier – and much sooner than expected.

🔑 What’s Changing?

- Starts Earlier: Launches 1 October 2025 (instead of January 2026).

- Just 5% Deposit: Buy with as little as 5% deposit, while the government guarantees part of your loan – saving you from costly Lenders Mortgage Insurance (LMI).

- No Income or Participation Caps: Open to all first home buyers, with no limit on how many can access the scheme.

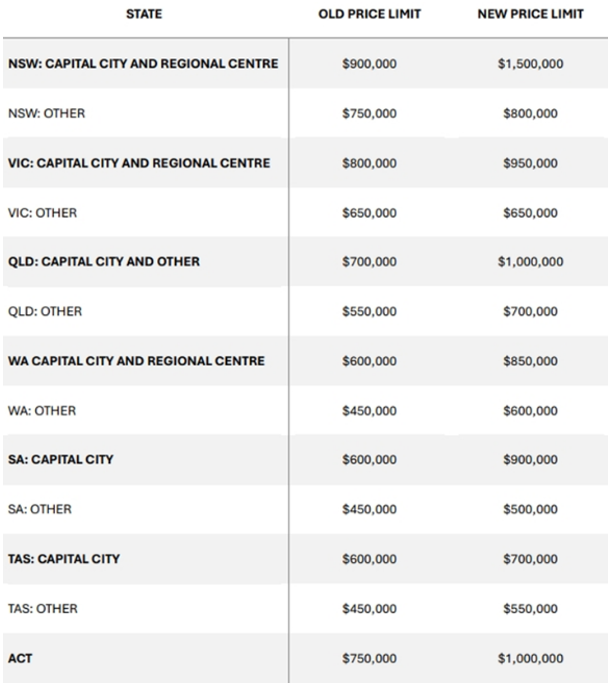

- Higher Property Price Caps: Updated thresholds mean you can buy more in today’s market:

- Sydney: up to $1.5m

- Melbourne/Geelong: up to $950k

- Brisbane/Gold Coast/Sunshine Coast: up to $1m

- Other regions also increased – ask us for your local cap.

💰 What This Means in Real Terms

- Brisbane example: Buy a $1m home with just $50k deposit, saving up to 10 years of saving time and around $42,000 in LMI.

- Sydney example: Purchase a $1.5m home with a $75k deposit, instead of the usual $300k (20%) deposit.

These changes could save you tens of thousands – and get you into your first home years sooner.

🏡 Ready to Take Advantage?

At Funds Assist Financial Services, we’ll guide you through every step – from checking eligibility to securing finance and getting the keys in your hand.

Next steps:

- ✅ Get your finances in order

- ✅ Speak with us to confirm eligibility

- ✅ Start planning now for a smooth purchase when the scheme launches.

📞 Let’s plan your first home purchase today.

📅 Book a Free Financial Review

Let’s arrange a quick, no-obligation, electronic meeting to discuss:

Your maximum borrowing capacity

A free financial analysis

A review of your current home loan rate (if applicable)